Financial results 2024

Ferd’s value-adjusted equity totalled NOK 50.4 billion as of 31 December 2024, up from NOK 45.8 billion as of 31 December 2023. In total, Ferd achieved a return on value-adjusted equity of 12.0 percent. The return in NOK terms was NOK 5.5 billion.

The return on Ferd Capital’s combined portfolio was 12.9 percent. Overall, there was a positive return for both the privately owned and the listed investments. The portfolio of listed investments had a return of NOK 2.2 billion, corresponding to 24.6 percent. Ferd’s return on its real estate portfolio was 8.1 percent. Ferd External Managers generated a total return of 19.1 percent (in NOK terms) on its mandates. Measured in USD, the return was 6.5 percent, primarily as a result of the weakened krone against the USD.

In 2024, Ferd made investments of NOK 1.5 billion and received NOK 4.7 billion from divestments and dividends. In Ferd Capitals portfolio, we invested NOK 0.9 billion to increase our ownership and support some of the portfolio companies. The largest divestments were the partial divestments in Elopak and Boozt, totalling NOK 1.7 billion. Ferd received a total of NOK 1.5 billion in dividends from the investments in Ferd Capital’s portfolio during 2024. Ferd also received a total of NOK 0.5 billion from allocations out of Global Equity and distributions from other funds in Ferd External Managers.

As of 31 December 2024, Ferd had cash and cash equivalents totalling NOK 3.7 billion. The value of Ferd’s listed investments and liquid fund investments was NOK 16.9 billion. In total, the value of Ferd’s cash and liquid investments was NOK 20.7 billion as of 31 December 2024. In addition, Ferd had undrawn credit facilities totalling NOK 7.0 billion. Interest-bearing debt in the parent company stood at NOK 1.0 billion on 31 December 2024.

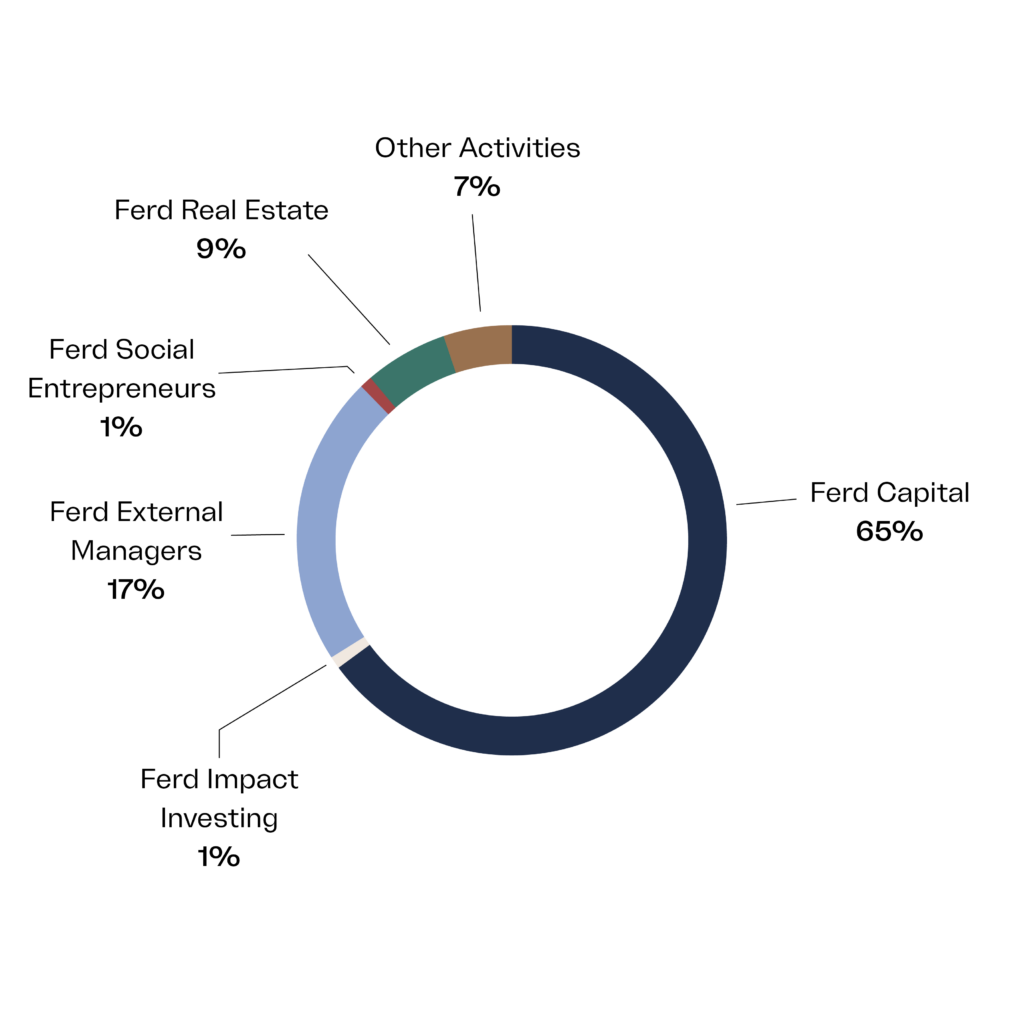

Composition of Ferd’s value-adjusted equity on 31 December 2024:

Ferd Capital

Ferd Capital is a long-term, flexible and value-adding partner for Nordic companies.

The business area has two mandates and makes investments in private and listed companies. On 31 December 2024, Ferd Capital’s portfolio of privately owned companies consisted of Aibel, Aidian, Brav, Fjord Line, Fürst, General Oceans, Interwell, Mestergruppen, Mnemonic, Norkart, Simployer and Try. The largest listed investments were Benchmark Holdings, Boozt, BHG Group, Elopak, Lerøy Seafood, Nilfisk and Trifork.

The combined return on Ferd Capital’s mandates was 12.9 percent in 2024. The portfolio of listed investments had a return of NOK 2.2 billion (24.6 percent). This was mainly driven by the 50 percent increase on the Elopak investment during 2024, but also the investments in BHG Group and Lerøy Seafood provided Ferd with double-digit annual returns. In May and September, Ferd sold a total of 42 000 shares in Elopak in a market transaction worth about NOK 1.5 billion. Aibel, Fürst, Mestergruppen, Norkart, and Simployer were the privately owned companies that contributed the most to the increase in value.

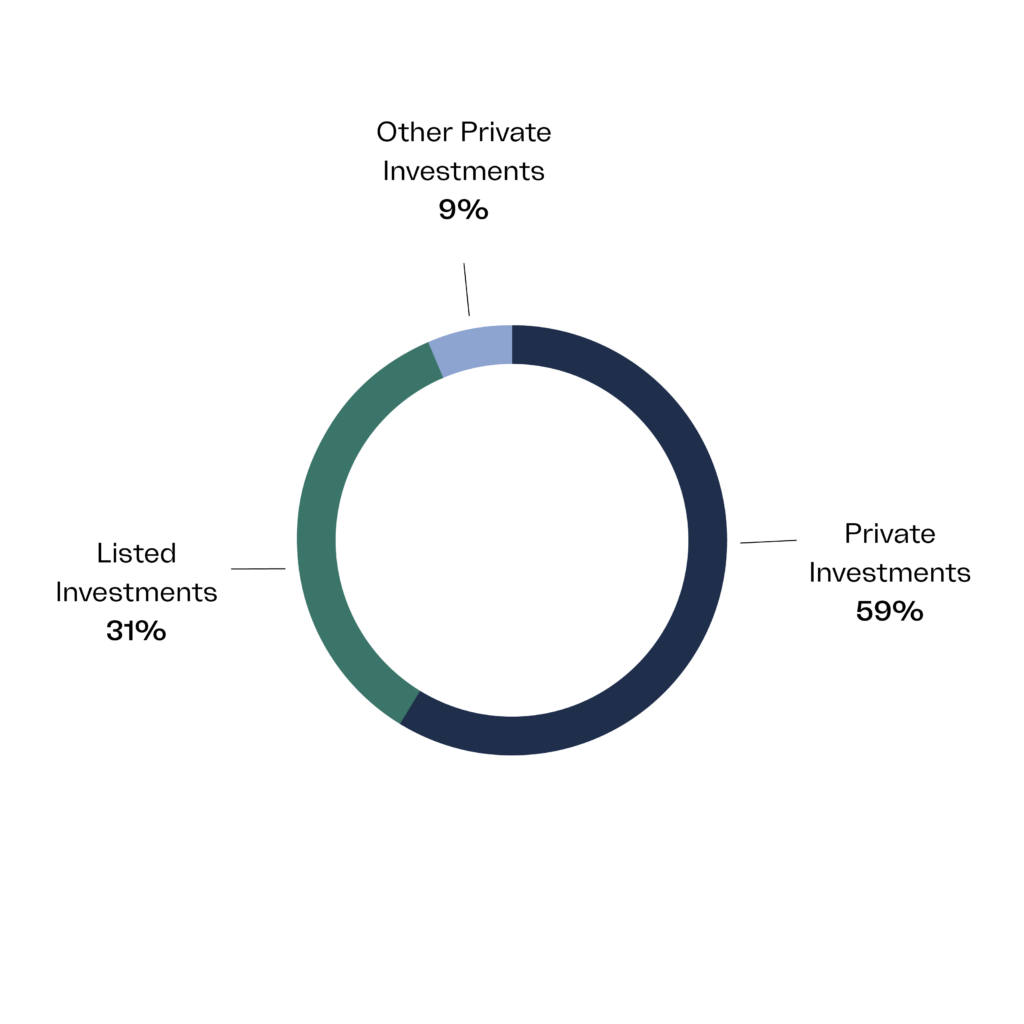

Ferd Capital’s portfolio had a total value of NOK 32.9 billion on 31 December 2024. The allocation between the two main mandates and other investments was as follows:

Ferd Real Estate

The return on Ferd Real Estate’s combined portfolio was 8.1 percent in 2024. The commercial real estate portfolio had a positive development in value due to increased occupancy rates and higher rental prices for its largest properties in Oslo’s central business district.

The combined portfolio of residential projects also had a positive value development during 2024. In the first half of the year, Ferd Real Estate finalized the Humlehagen project and handed over all the 142 apartments to new residents.

Ferd Real Estate made no major new investments in 2024 but invested NOK 0.4 billion in their existing commercial and residential projects.

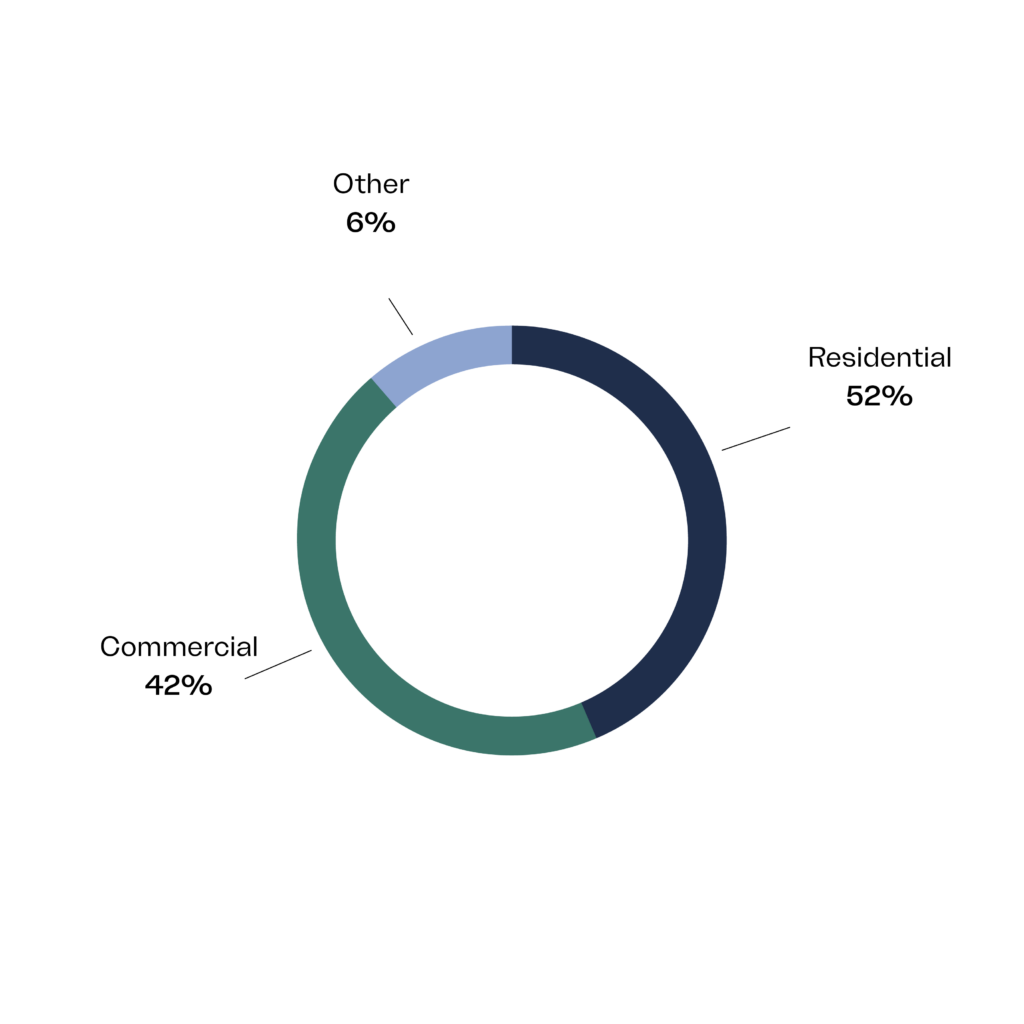

At the end of 2024, Ferd Real Estate’s portfolio had a property value of NOK 11.3 billion and an equity value of NOK 4.7 billion. As of 31 December 2024, the value was distributed between the segments as follows:

Ferd External Managers

Ferd External Managers is responsible for the group’s investments with external managers. The business area invests in funds exposed to markets that complement the rest of Ferd.

Ferd External Managers had an aggregate return of 19.1 percent (measured in NOK) for their mandates in 2024. The portfolios are accounted for and managed in US dollars. Measured in USD, the return was 6.5 percent as a result of the weakening of NOK against the USD during 2024.

The Global Equity mandate, which is made up solely of long-only equity funds, had a value increase of 6.1 percent measured in USD. This was below the return for the benchmark index this portfolio is measured against.

The Global Fund Opportunities portfolio consists of investments in hedge funds and illiquid funds. The mandate had a return of 7.1 percent measured in USD in 2024. All the hedge funds had a good performance last year with returns above 10 percent.

Ferd allocated NOK 250 million out of the Global Equity mandate in 2024 and received NOK 210 million in cash distributions from the investments within the Global Fund Opportunities portfolio. The value of Ferd External Managers’ combined portfolio as of 31 December 2024 was NOK 8.4 billion.

Allocation of the Ferd External Managers portfolio between the mandates on 31 December 2024:

Ferd Impact Investing

Ferd Impact Investing invests in early-phase companies with the potential to deliver both a positive impact on the UN’s Sustainable Development Goals as well as a robust risk-adjusted return. The business area primarily invests through funds, but also makes direct investments in individual companies in partnership with others.

To date, Ferd Impact Investing has invested in and made commitments for 30 investments – 16 funds and 14 direct investments. During 2024, they committed and invested capital for a total of NOK 174 million.

As of 31 December 2024, Ferd Impact Investing had invested NOK 660 million in current investments and committed a further NOK 404 million. The fair value of Ferd Impact’s portfolio was NOK 786 million.

Ferd Social Entrepreneurs

Ferd Social Entrepreneurs (FSE) invests in social entrepreneurs who create social and financial results. Through a combination of capital, competence, and networks, the goal is to strengthen the companies’ opportunities for success. FSE also collaborates with the public sector to contribute to new tools and improved framework conditions for social entrepreneurs.

At the end of 2024, there were 11 companies and four fund investments in FSE’s portfolio. The largest investment is in Auticon, which is the world’s largest company where the majority of the employees have an autism diagnosis.

FSE also manages Ferd’s “Oslo initiative.” In this initiative, they gather businesses and foundations for a joint effort in four vulnerable areas in Oslo. Together, they aim to contribute to creating more jobs, increasing school motivation, and encourage meaningful leisure time. Since its inception in 2022, the Oslo initiative has supported 21 organizations.

Other Activities

Other activities mainly consist of money market funds, bank deposits, and investments in prior mandates under liquidation.